-

Posts

10,724 -

Joined

-

Last visited

-

Days Won

198

Content Type

Profiles

Forums

Gallery

Downloads

Store

Everything posted by ice-capades

-

You should check with your Dealer but if you've got a scheduled order, with a build date in 2 weeks, your order is most likely "locked in" for production.

-

2022 Super Duty Orders & Discussion

ice-capades replied to mrmallerd's topic in F-Series SuperDuty Forum

NO. OTD orders are Dealer stock orders for the vehicles that are part of the OTD ordering and scheduling process. OTD Vehicle Line Scheduling has nothing to do with Retail orders! -

2021MY F-150 Auto Start-Stop Removal Availability ACTION REQUESTED • Please be aware of new availability of Start-Stop Removal option for 21MY F-150 and resulting impact to scheduling orders. SUMMARY As a way for U.S. customers to get their F-150s sooner, Ford will implement an optional Auto Start/Stop removal on F-150s for the balance of the year. The F-150 is being prioritized over other vehicles because it is the fastest to implement and satisfy customer demand. Those who decide to purchase an F-150 with the optional start/stop removal will receive a $50 credit. Auto Stop/Start will be removed from the standard section of all Monroney labels. The removal option will be shown in the optional section of the Monroney sticker as Auto Start Stop Removal. Implementation timing estimates for F-150 (3.5L, 2.7L and 5.0L) is late August/early September. The Auto Start/Stop function will remain as standard equipment for those customers who prefer it. However, the delivery timing for those vehicles will be longer. • To optimize availability of Start-Stop functionality, all stock orders will be required to be modified to include the Start-Stop Removal feature for scheduling until further notice. • Retail and Fleet orders may retain this feature at their discretion. • Existing unscheduled Stock orders will be amended to include 52X. • Newly entered stock orders will require 52X to be added during order submission. • To align with current chip availability, some previously scheduled stock orders with the above configurations will be spec changed to add the Auto Start-Stop Removal (Option Code: 52X). • Updated J1 and J2 order guides and pricing will be posted to FMCDealer on Monday August 2, 2021. Note: Removal of Auto Start-Stop functionality will impact fuel economy on those affected units. Updated EPA-estimated fuel economy will be printed on window labels.

-

The following updated order guides are now available for download in the Dealer Order Guides section. 2021 F-150 Order Guide 2021 F-150 Order Guide (Canada) 2021 F-150 Order Guide Job #2 2021 F-150 Police Responder Order Guide 2022 Maverick Order Guide 2022 Transit Connect Van Order Guide 2022 Transit Connect Wagon Order Guide

-

2021 F-150 Order Guide Job #2 View File 2021 F-150 Order Guide Job #2 Submitter ice-capades Submitted 08/03/2021 Category F 150

-

-

Where are the Mustang S650 prototypes?

ice-capades replied to Twin Turbo's topic in Ford Motor Company Discussion Forum

Thanks, I'd forgotten about that. Then perhaps they'll use FRAP as a 2nd Mach-E plant based on future battery supply and sales and use the existing plant primarily for Mach-E exports. Mach-E could also possibly share FRAP BEV production with another vehicle that shares the same chassis or whatever the next generation Mach-E will use. Ford probably knows what they're planning but won't reveal anything until they're ready, etc. -

In CT, the state DMV treats the Dealers like collection agencies. If there's any outstanding or back tax issues, including child support, the Dealer has to collect the money from the customer, go pay the outstanding taxes and get a receipt that then has to be sent to DMV for processing. Only after all that's completed will the DMV process the registration application, regardless of whether it's a new registration or a transfer. It can get time consuming and include paying drivers to pay the taxes, etc. With New York or Massachusetts registrations, the dealership usually sends drivers to register the vehicles but with other states a registration service is used. It's part of the expenses covered by the "Doc" fees that are charged.

-

Per Friday's FDNB (Fleet Distribution News Bulletin) here's the production timetable for the 2021/2022MY Transit. 03/24/2021 - 2021MY Final Fleet Order Due Date 08/12/2021 - 2021MY Last Day to Spec Change 11/05/2021 - 2021MY Balance Out Date 08/31/2021 - 2022MY Order Bank Open Date 09/16/2021 - 2022MY Scheduling Begins 11/08/2021 - 2022MY Job #1 Date

-

Per Friday's FDNB (Fleet Distribution News Bulletin) here's the updated production timetable for the 2021/2022 Ford Ranger. 06/25/2021 - 2021MY Fleet Final Order Due Date 09/23/2021 - 2021MY Last Day to Spec Change 12/10/2021 - 2021MY Balance Out Date 09/20/2021 - 2022MY Order Bank Open Date 10/14/2021 - 2022MY Scheduling Begins 12/13/2021 - 2022MY Job #1 Date

-

2022 Explorer Production Information

ice-capades replied to ice-capades's topic in Explorer, Mountaineer, Sport Trac Forum

Per Friday's FDNB (Fleet Distribution News Bulletin), the updated scheduling and production timetable has been released for the 2021/2022MY Explorer. 06/25/2021 - 2021MY Fleet Final Order Due Date 08/19/2021 - 2021MY Last Day to Spec Change 10/31/2021 - 2021MY Balance Out Date 07/30/2021 - 2022MY Order Bank Open Date 09/23/2021 - 2022MY Scheduling Begins 11/02/2021 - 2022MY Job #1 Date -

I agree with most of what you've said but have to question what employee compensation has to do with it. The employees are paid to do a job whether it's assembling ICE or BEV vehicles and are paid well even when plants are down. It's acknowledged that BEV vehicles will be less labor intensive yet the UAW is understandably trying to protect their interest by maintaining the current UAW staff levels. Ford, GM and the other domestic OEM's will unfortunately continue to cave in to whatever the UAW demands, which they've done repeatedly for decades now, because of the dreaded fear of a prolonged strike which hasn't happened in decades. Yes, Farley has to stay disciplined but what "metrics" are involved regarding employee compensation remains to be seen. The situation was changed years ago when the domestic manufacturers agreed that any future facilities would be part of UAW collective bargaining agreements. The companies should never have agreed to giving the UAW blanket inclusion in future facilities without going through the traditional and established NLRB processes and they'll now never be able to get out of it. Just look at when Boeing needed to expand production for commercial aircraft and, because of the long history of problems with the unions representing workers in Everrett, WA, built a new non-union facility in SC.

-

The microchip shortage isn't going to evaporate any time soon. It appears the situation will improve soon for Ford and the automotive segment but Intel's CEO thinks it could take until 2023 before there's enough production capacity again to meet the demand from all the market segments. Part of the solution is increasing production outside Taiwan but it takes over a year to build new facilities and get them into production. Intel is investing $20B in two new plants in AZ but it'll be 2023 before they're up and running. The automotive manufacturers have finally been able to break the incentive/rebate situation that GM started in 1986. It's going to take both changes and discipline for them to learn from the past and apply the recent lessons learned from the benefits of managing reduced inventory and incentives and the resulting positive impact on profits. Those same benefits have also impacted the reduced floorplan expenses and profits at the dealership level. Both the OEM's and dealerships need to seize the opportunity and commit to making inventory management changes that will benefit them both long term instead of making the continued short-term decisions that have been so expensive. The subject of reducing the "build combos" is an old subject and just never seems to get better. If anything, it keeps getting worse and the priorities at Ford and its dealerships are often in conflict. Ford basically knows what it can build based on plant and supplier capacity but has often prioritized its objective over both market and customer demand in order to maximize profits even though it may mean lower plant utilization and lost market share. In order to be successful at working with reduced inventory and improved profit margins, Ford absolutely needs to simplify the ordering process. Customers placing retail factory orders often want as many free-standing options as possible but doing so increases the complexity of dealing with manufacturing issues, commodity restraints, etc. The more build combinations available, the more complex the ordering, scheduling, supplier and commodity issues become along with all the time involved in dealing with all the related issues.

-

Okay. Interesting.

-

Sales tax is based on the address where the vehicle will be registered. There are some states that have different tax rates in different areas.

-

The COVP enrollment requires the Dealer to upload a copy of a signed Buyer's Order and the customer's Driver's License. The required $500 deposit applies only to CA. There is no deposit required for customers in any other state.

-

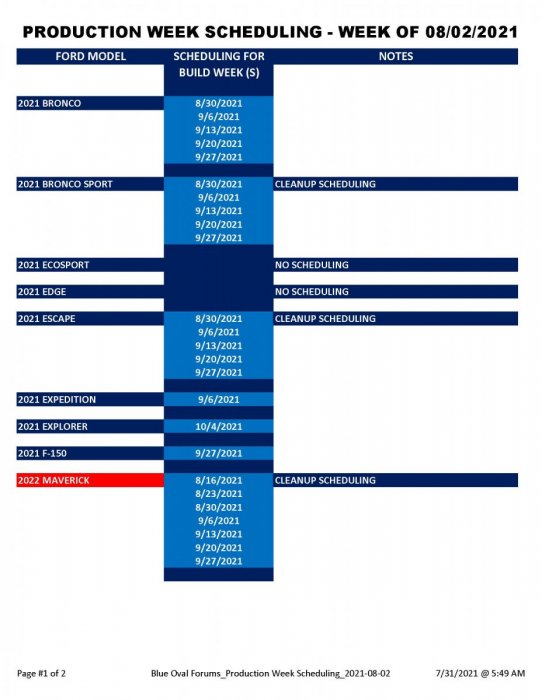

Production Week Scheduling Information

ice-capades replied to ice-capades's topic in Production and Sales

SCHEDULING TOOLBOX - SCHEDULING PLAN This is the tentative scheduling plan for the production period. This is just a guide for scheduling. This information is tentative and may change at any time. THIS INFORMATION APPLIES TO UNSCHEDULED ORDERS ONLY. Blue Oval Forums_Production Week Scheduling_2021-08-02.pdf -

2022 Explorer Order Guide View File 2022 Explorer Order Guide Submitter ice-capades Submitted 07/30/2021 Category Explorer

-

-

You're barking up the wrong tree and I'm not buying what you're selling. You always know best, the Dealers can't be trusted, you can never get the vehicle you want at the price you want, equipped as you want, when you want and if you order it, you're afraid they'll sell the vehicle to someone else when it arrives. I've heard this song from you too many times before. You don't know what you're talking about! Period.

-

2022 Super Duty Orders & Discussion

ice-capades replied to mrmallerd's topic in F-Series SuperDuty Forum

No. You should check with your Dealer for the latest status update. -

CEO Farley isn't the first CEO to talk about better inventory management and a shorter OTD (Order to Delivery) timeline. Years ago, there was a stated objective for a 15-day OTD but instead the OTD continued to get longer. The quickest I've ever seen was 3 weeks. The 1986 Thunderbird was in "Balance Out" scheduling and the regional office called us, being one of the top 10 Thunderbird dealerships, asking if we wanted 50 extra Thunderbirds. We agreed to take the extra 50 units, placed the orders within an hour or so, and sent the order information to the regional office. The orders were scheduled within 24 hours, in production within a week, and delivered within 3 weeks. The only other time I've seen anything similar was a vehicle that the regional office asked us to order for a friend of Mark Fields when he was the Ford CEO. That vehicle was scheduled an hour later and delivered to the dealership in 3-4 weeks. Ford's real customers are the dealerships which buy the inventory and allocation that the Ford Zone Managers sell and help keep the plant schedules busy and the product flowing. Ford gets paid for the vehicles (Stock, Retail or Fleet) when they're shipped or delivered to the dealerships and in the majority of cases dealerships then finance that inventory with a wholesale credit line through Ford Credit. Ford and much of the industry has worked with excessive inventory stock for years and it's become imbedded in the operational model in order to be competitive. As difficult as the market situation has been the past year due to the pandemic, microchip shortage and other factors, manufacturers have had to develop better inventory management procedures in order to maintain both sales and profit objectives. One of the major benefits has been the elimination of most incentives, greatly improving profits to both Ford and its Dealers. And in the process, Ford has started the COVP (Customer Order Verification Program) providing incentives to the customers placing factory orders along with expedited retail order scheduling using incremental allocation. What remains to be seen is how much Ford has learned and how much its committed to their inventory management plans going forward. It's not going to happen overnight and certainly not until production schedules are back to something even close to normal or at least predictable. There's a big risk taht dealerships are going to take every bit of allocation and production they can get to rebuild their stock inventory and end up back with the bloated inventory they've worked with, and accepted as normal, for decades. And should that happen, Ford and its competitors will be back in the incentives game again. Success hides a multitude of sins and both Ford and its Dealers are going to have to exercise a lot of discipline and commitment in order to make a new inventory management plan succeed. If they do, both Ford and its dealerships can substantially reduce expenses and dramatically improve profitability. The risk at the corporate level is that some Ford executive in Dearborn is going to make decisions making the process more involved and complicated than necessary making it so much more difficult to achieve the desired objective. At the same time, the problem exists with those weak and/or mismanaged dealerships that won't admit or realize the benefits of changing their inventory management at the dealership level. It actually takes more time and effort to manage reduced inventory as there's a smaller margin of error in stocking the right inventory mix to meet customer demand. The other major factor to be dealt with is improved supplier relations and delivery to reduce the commodity restraints impacting order scheduling and production. Al of these matters will take time to implement, along with the processes to make them work. And part of the process in achieving the objective has to a better working relationship with Dealers.